Summary

In my Analysis of Bom Sucesso Resort’s development, focusing on Villas, I challenge the reported completion of 402 out of 600 buildings by early 2024. In conclusion, I stress the need for stakeholders to focus on completing the entire Analysis of Bom Sucesso resort, urging administrative responsibility and an inquiry into major plot owners’ intentions.

Disclaimer: The information contained is to the best of my knowledge at the date, and I’m happy to correct any typo or error.

Intro

According to the condominium administration, 402 out of 600 buildings within the Bom Sucesso Resort have been completed by the beginning of 2024. However, strolling through the resort feels less than 66% is done. And I’m questioning if BSR management and major stakeholders intend to finish BSR.

As part of my ongoing Analysis of Bom Sucesso, I’m questioning whether the management is genuinely committed to the future of the resort.

> Can we anticipate completing the remaining 200 buildings within the next ten years, given that it took 20 years to construct the initial 400 buildings?

Twenty years ago, in 2004, Bom Sucesso Resort was first presented to the public (article here), and in 2006, when they announced the second phase, they aimed to finish construction by 2011 (article here).

The resort faced challenging times by being bankrupt in 2014 (article here); at that time, Maria da Graça Meireles from BS Villas, who was responsible for the BSR Condominium administration, said about the resort: “Now it’s not even about completing it, but about saving it’.” I want to learn from the current management led by Eduardo Montenegro if this is still the case or if they feel responsible for finishing the resort.

Edit: In 2015 when the Onebiz Group took over BS Villas, the CEO Pedro Portugal said: “I think that within two or three years the project will be practically finished”. (Article here)

Good news: In the last two years, I have witnessed the resort gaining momentum with a growing community and progressing toward completion. But can we see this in numbers? The turn of the year was an excellent time to take a snapshot of Bom Sucesso Resort’s development.

The Analysis of Bom Sucesso includes examining the architectural integrity of the remaining buildings.Through my Analysis of Bom Sucesso, I aim to reveal the true state of the resort’s development.This Analysis of Bom Sucesso not only focuses on villas but also on the resort’s overall progress.

Analysis January 2024

In my Analysis of Bom Sucesso, I have noted the impact of subcondominiums on the overall community.

I compiled this dataset independently, personally counting houses, assessing development status, and interpreting the data. This data set will be more meaningful, comparing it over the coming years. Despite my inquiry, the condominium could not provide me with any data for this assessment.

My primary focus is on the villas at Bom Sucesso, but I’ll briefly touch on other projects. Notably, long-standing issues with “The Three Large Ruins” have remained in this state for a decade.

Sub-condominiums

As we can see in this Analysis of Bom Sucesso, commercial buildings play a crucial role in attracting visitors.

Subcondominiums are predominantly row houses sharing a garden and pool at Bom Sucesso, with 15 at BSR (by counting the plot numbers). One, Caminho do Lago 13-21, Lot 234, remains unbuilt. Two are stopped, and I think they strongly impact BSR’s reputation:

Continuing my Analysis of Bom Sucesso, I will highlight the importance of the hotel industry in the resort’s success.

This Analysis of Bom Sucesso indicates a significant number of villas still need to be addressed.

- Lot 288 on Rua Bela 7-55 is owned by Abanca Bank.

- Lot 313 on Rua da Lagoa 28-58, “The Fingers,” is owned by Sintonizavalor soc imobiliaria lda

In my Analysis of Bom Sucesso, I will compare this year’s status with past data.

Commercial Buildings

The Analysis of Bom Sucesso shows that even with ongoing challenges, the community is hopeful.

This Analysis of Bom Sucesso points to the need for renewed efforts to finish what has started.

Initially planned for Hilton with 120 beds, the hotel faced a construction halt in 2014. Owned by Roberto Solis SA (BS Villas) today, the completion status of this hotel significantly influences other investors’ decisions. Furthermore, a functioning hotel is imperative for Bom Sucesso to call itself a resort.

Through this detailed Analysis of Bom Sucesso, I encourage stakeholders to take action.

Let’s focus on Villas at Bom Sucesso for this analysis in January 2024.

The Analysis of Bom Sucesso will provide a clearer picture of the property landscape.

Out of the initially planned 326 villas at Bom Sucesso Resort, the current status reveals that only 159 have been completed (49%), while 138 villa plots are empty (42%).

Continuing the Analysis of Bom Sucesso, the importance of plot ownership cannot be overlooked.

This ongoing Analysis of Bom Sucesso reveals critical insights into land ownership and strategy.

In this Analysis of Bom Sucesso, I highlight the role of companies advancing construction.

Furthermore, my Analysis of Bom Sucesso will acknowledge the contributions of private owners.

As part of the Analysis of Bom Sucesso, it is essential to monitor changes in city property ownership.

In conclusion, this Analysis of Bom Sucesso indicates the need for proactive strategies.

Sixteen villas (5%) are currently under construction. With the hopeful completion this year, the development progress would surpass 50%.

This comprehensive Analysis of Bom Sucesso will continue to evolve as new data becomes available.

Thirteen villas (4%) are in a construction suspension/“ruins.”

Comparing this year’s data with data published by the press teen years ago, when BSR went bankrupt, it reveals progress: The press reported at that time (here) that 350 buildings were built, and 80 houses were under construction, but many of them were being stopped.

Since the historical data does not focus on just villas, we need to compare it to the 402 Buildings reported as finished by the administration. It shows progress; luckily, we no longer have so many ruins. However, the progress does not show enough speed to finish the other 200 buildings in the next ten years.

Edit: An academic study (here), based on official data from the city of Obidos, reported 338 finished houses in 2014. This shows only 64 buildings have been completed in the last ten years. When the development continues at this speed, it will take 30 more years to complete the resort.

Plot ownership

Abanca Bank is the leading owner of 37 undeveloped villa plots and owns one stopped villa project. (They have 11% of the condominium votes)

The second largest landowner is “Sintonizavalor soc imobiliaria lda” with 28 undeveloped plots, three stopped, and only one finished Villa. One project was in progress, but it has been months since I have seen activities, so I categorized it as stopped.

Intriguingly, these two major players own 47% of all empty plots, including premium locations designed by top architects like David Cahperfiled, Álvaro Leite Siza, and Manuel Aires Mateus. Since they don’t own finished villa projects (except one), I could not find their plots listed on public real estate platforms like Idealista. The question arises: What are their intentions for these plots? Are they strategically holding them back?

A notable actor driving progress is the company named Round B, which is actively finalizing the construction of three red houses at the lake. Additionally, they have acquired a few more properties to complete existing structures and initiate new buildings from scratch.

Some private owners are finishing villas, which I do not list here.

Over the last two years, the City of Óbidos has sold six plots. Only two plots remain under their ownership, showcasing a significant shift in the city’s property portfolio at BSR.

The BBVA Bank currently holds seven plots. They intend to exit the BSR market. In mid-January, they tried to sell all plots via action, starting at 85k Euro, but none got sold. (Action here)

Real Estate Market

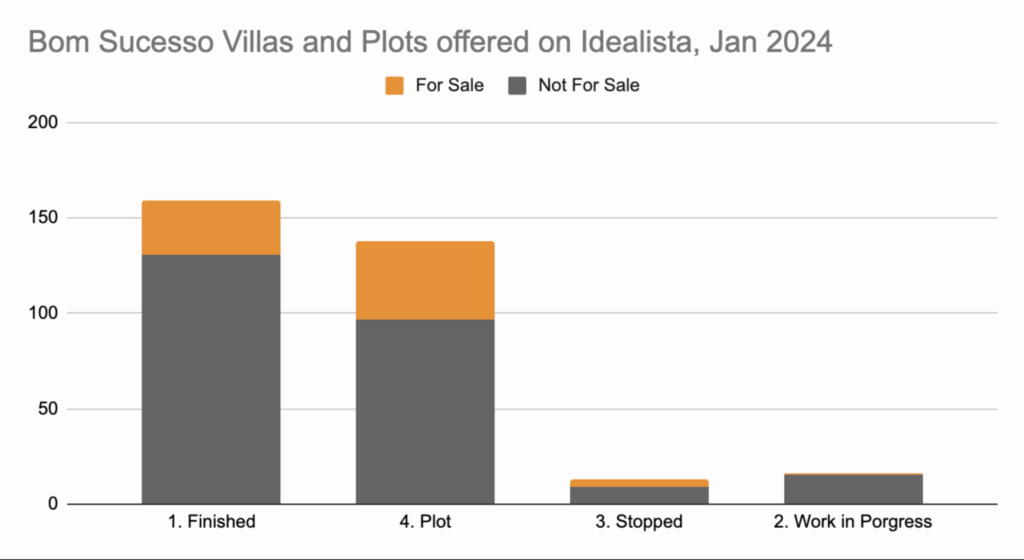

I took an interest in taking a snapshot of the number of villas and plots offered on the real estate market (while I’m not monitoring house prices). As of early January 2024, the data on Idaialista reveals a dynamic landscape:

- Finished Villas: 28 units (18%) are currently listed for sale.

- Empty Plots: 41 plots (30%) are available for prospective buyers.

- Stopped Projects: 4 projects (31%) are on the market. Some are available in their current state, while others are offered the option of services to complete their construction.

In addition to the villa offerings, the market provided ten Sub-Condominium Units and one commercial property for sale.

Conclusion:

Focus on the Big Picture:

As stakeholders of Bom Sucesso Resort, we should focus on the grand vision of completing the entire resort. We must transition into a scale mode by finding like-minded investments to ensure sustained growth. This venture can only succeed if we grow it to its full potential.

Administrative Responsibility:

Get the commitment from the Bom Sucesso management, led by Eduardo Montenegro, to complete the resort. And to establish the foundational conditions for fostering growth.

Hotel and Sub-Condominium Status:

Hold the BSR administration accountable for promoting the completion of “The Three Big Ruins”, and requesting reports about the status on a quarterly base.

Major Plot Owners’ Intentions:

Inquiring into the intentions of major land owners, such as Abanca Bank and Sintonizavalor soc imobiliaria lda, becomes paramount. Owning a significant percentage of empty plots, their strategies can significantly impact the future development and market dynamics at Bom Sucesso Resort.